In the world of entrepreneurship, a well-structured business plan serves as the authority for growth, financing, and long-term success. However, misstatements often circulate about what business plans contain and how they should function. In this article, we’ll consider common myths and misconceptions about business plans, conduct a deep dive into their true entrails, and finally answer the central question: Which of the following is not a true statement about business plans?

Understanding the Purpose of a Business Plan

A business plan is more than just a recorded document; it is an important roadmap that outlines a company’s goals, objectives, market, aggressive strategy, financial projections, and practical structure.

It serves multiple purposes:

- Attracting investors and lenders

- Guiding internal decision-making

- Tracking progress over time

- Identifying opportunities and risks

An appropriately accomplished business plan improves the possibility of success and acts as a reference point for entrepreneurs.

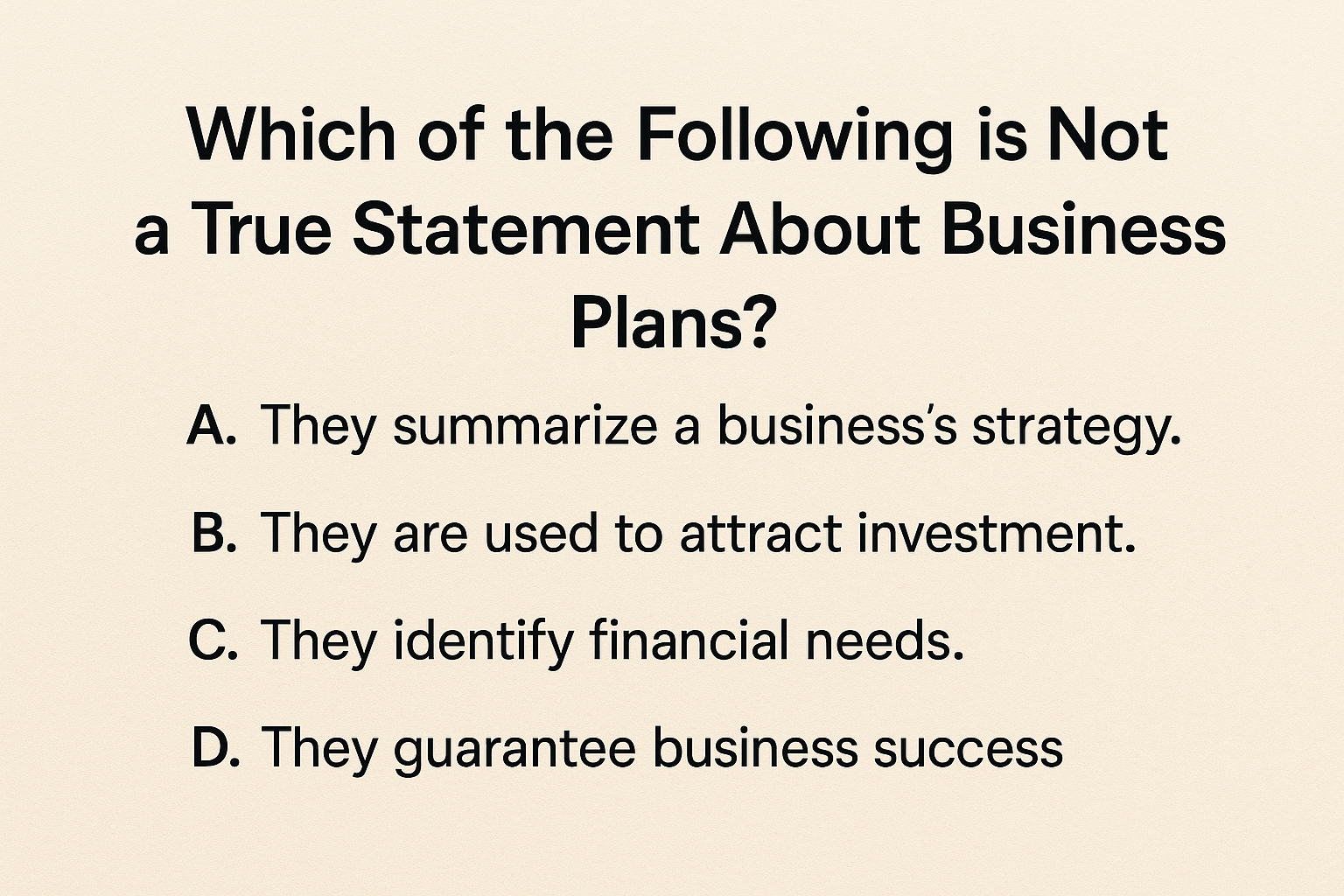

Common Statements About Business Plans — Which One Is False?

Let’s break down several commonly circulated statements about business plans and analyze them:

1. Business Plans Are Only Necessary for Startups

False. While startups often rely on business plans to protect funding or define their introductory market strategy, established businesses also use them to fulcrum, launch, or launch new products. Updating a business plan automatically is crucial for continued growth and flexibility in changing market conditions.

2. A Business Plan Guarantees Success

False. This is the most ambiguous allegation about business plans. While a good business plan escalates the chances of achievement by providing clarity and direction, it does not assure positive outcomes. External considerations such as market vaporization, competition, and commercial downturns can still affect business performance.

3. Business Plans Should Include Financial Projections

True. A powerful business plan must contain accurate financial statements, including an income statement, cash flow analysis, and balance sheets. These phonemes help assess profitability, funding needs, and long-term growth.

4. Business Plans Are Only for Investors

False. While shareholders and banks require business plans to appraise risk, internal stakeholders, including leadership teams and institutes, also benefit from compassionate strategic guidance and policy-making goals.

Essential Components of a Business Plan

To distinguish truth from fiction, one must understand what a professional business plan typically includes.

Below are the essential sections:

1. Executive Summary

This high-level analysis should shortly outline the business idea, mission statement, program, and a snapshot of financials. It is the first passage but is often written last.

2. Business Description

Here, the company minutiae its structure, partnership, location, and legal framework. This section often analyzes the history, background, and long-term vision of the company.

3. Market Analysis

This incorporates deep exploration into the target market, customer demographics, adversary analysis, industry trends, and market gaps. Credible authority and data should support all observations.

4. Organization and Management Structure

This part determines key players in the business, from architects to department heads, outlining their roles, backgrounds, and contributions to the company’s success.

5. Product or Service Line

Presentation of what the business offers: this department focuses on unique selling points, product lifecycle, investigation and development plans, and any intellectual property held.

6. Marketing and Sales Strategy

This allocation includes brand adjustment, pricing, sales funnel, advertising campaigns, digital marketing efforts, and purchaser confinement strategies.

7. Funding Request (if applicable)

When searching for capital, entrepreneurs must explain how much funding is essential, how it will be used, and what return shareholders can expect.

8. Financial Projections

Forecasts for the next 3–5 years should comprise profit and loss statements, cash flow estimation, balance sheets, and break-even analysis.

9. Appendix

Approving documents such as resumes, licenses, permits, legal agreements, and product images are commonly included here.

The Biggest Misconception About Business Plans

The most inaccurate statement commonly made about business plans is.

Once written, a business plan doesn’t need to be updated.

This is not true. Business environments are dynamic. Market demands, technologies, regulations, and consumer behaviors evolve constantly. To remain relevant, a business plan must be.

- Reviewed regularly

- Revised based on performance metrics

- Adapted to new goals and challenges

Failing to update a business plan is equivalent to using an outdated GPS; you may eventually reach your destination, but not without wrong turns and wasted time.

Why Business Plans Still Matter in 2025

In today’s fast-paced digital economy, some entrepreneurs may question the relevance of traditional business planning.

But in reality, a business plan is even more crucial today:

- Investors still demand clarity before writing checks.

- Banks require financial foresight before lending.

- Team alignment depends on shared vision and strategic clarity.

- Digital marketing and SEO strategies require budget allocation and ROI tracking, all stemming from a detailed plan.

How to Ensure Your Business Plan Is Effective

To make your business plan stand out and deliver results, consider the following tips:

- Use real, updated market data instead of assumptions

- Make your executive summary compelling and investor-friendly

- Ensure financials are backed by logic and evidence

- Avoid jargon and keep the language clear

- Revisit the plan quarterly or annually to adjust strategies

A static plan is a failed plan. A dynamic, evolving business plan is a true asset.

Conclusion

An essential tool for giving any endeavor structure, strategy, and direction is a business plan. By providing a clear road forward, it greatly raises the possibilities of success, even though it cannot guarantee it. Its actual potential can be hampered by misconceptions like the idea that it exclusively benefits external parties or that it assures results. To remain in line with changes in the market, the plan must be updated regularly. The secret to long-term success is data-driven, adaptable, and well-informed business planning.